Cyber Insurance has become a critical component of corporate risk management, providing financial protection against cyberattacks, data breaches, and other cyber incidents. However, its growing role also has significant implications for corporate security policies, influencing everything from risk assessment to incident response strategies. Let’s explore how cyber insurance impacts corporate security policies and how organizations can effectively navigate this landscape.

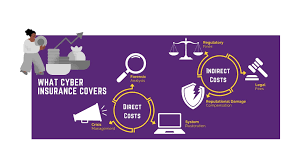

Cyber insurance is a type of coverage designed to help businesses mitigate the financial impact of cyberattacks and data breaches. It typically covers:

Data breach costs (notification, legal fees, public relations)

Ransomware attacks (payment, data recovery)

Business interruption (revenue loss during downtime)

Third-party liabilities (legal action from customers or partners)

Forensic investigation and incident response costs

The policy may vary depending on the insurer, but in essence, it aims to cover the financial aftermath of a cyber event, offering protection against incidents that can lead to significant costs and reputational damage.

Cyber insurance has become more important as cyber threats have evolved. With the increasing frequency and sophistication of attacks such as ransomware, data breaches, and supply chain disruptions, businesses are turning to cyber insurance as a way to transfer some of the risks associated with cyber threats.

| Global Cyber Insurance Market Size (2023) |

|---|

| Estimated to be over $20 billion and expected to continue growing as cyber threats evolve. |

Organizations across all sectors—especially those dealing with sensitive data—are now viewing cyber insurance not just as an option but as a necessity.

Many insurers now require organizations to meet certain security requirements before issuing a policy. These include implementing best practices like:

Multi-factor authentication (MFA)

Regular patching and updates

Strong endpoint protection

Encryption of sensitive data

Network segmentation and firewalls

These requirements force organizations to strengthen their cybersecurity posture and align their security strategies with industry standards. Essentially, to secure insurance coverage, companies must demonstrate that they are taking proactive measures to reduce risk.

Cyber insurance policies often come with requirements tied to compliance frameworks such as:

GDPR (General Data Protection Regulation)

HIPAA (Health Insurance Portability and Accountability Act)

NIST (National Institute of Standards and Technology)

ISO/IEC 27001 (Information security management)

To qualify for cyber insurance, companies must demonstrate that they comply with applicable regulations and frameworks, ensuring their policies align with global or industry-specific security standards.

Cyber insurance policies can influence how companies prepare for and respond to cyber incidents. Insurers may require:

Incident response plans that outline clear procedures for detecting, responding to, and recovering from attacks.

Third-party vendor assessments to ensure that partners and suppliers also have adequate cybersecurity measures in place.

Forensic investigations post-incident, including determining the root cause of a breach, which may help in both mitigating future incidents and improving security practices.

Insurance can thus act as a catalyst for improving incident response capabilities, ensuring that companies have an organized and well-defined approach to handle cyber risks.

With cyber insurance becoming a common requirement, organizations are increasingly incentivized to invest in advanced security tools (e.g., SIEM systems, endpoint detection and response (EDR)) and employee training to reduce the likelihood of a claim. Insurers may offer premium reductions for organizations that demonstrate strong security measures.

For example:

Companies that implement Zero Trust architectures might receive lower premiums.

Businesses with 24/7 security monitoring and proactive threat hunting can demonstrate their commitment to preventing incidents.

This, in turn, strengthens the overall security culture within an organization and pushes for continuous improvement.

While cyber insurance can help mitigate financial risks, it also introduces a cost. Here’s a breakdown of the key factors influencing the pricing and terms of coverage:

Higher premiums: Organizations with poor security measures or a history of incidents typically face higher premiums.

Deductibles: The higher the deductible, the lower the premium. However, companies with higher deductibles must pay more out-of-pocket in the event of an incident.

Organizations with a history of frequent claims may face higher premiums or difficulty obtaining coverage. This creates an incentive for businesses to focus on improving their cyber resilience.

Cyber insurance policies differ in their coverage and the limits they offer:

Basic coverage: Covers only the direct costs of a data breach (e.g., notification, legal fees).

Comprehensive coverage: Includes costs related to business interruption, data loss, and reputation management.

Ransomware coverage: Some insurers cover ransomware payments or recovery costs, but this is typically subject to strict conditions.

The choice of policy depends on the organization’s cyber risk profile, budget, and the value of the data they hold.

Ransomware payments: Some policies may exclude ransomware payments or place limits on how much can be reimbursed for ransom demands.

Social engineering: Insurance may not cover incidents that result from phishing or social engineering attacks unless they are tied to a broader security breach.

Act of war: Some policies exclude attacks attributed to nation-states or cyber warfare.

Organizations must fully understand the terms and exclusions in their policies to avoid misunderstandings when an incident occurs.

Insurers may require detailed records of security assessments, vulnerability scans, and patch management logs. These records may become a crucial part of the claims process.

As cyber threats evolve, so too will cyber insurance policies. Expect:

Dynamic risk assessments based on real-time threat intelligence.

Adjustable premiums depending on the organization’s security practices and threat landscape.

Tailored coverage that focuses on specific attack vectors (e.g., ransomware, insider threats, or DDoS).

Future policies may leverage AI to adjust premiums and claims based on real-time data, ensuring that businesses with high cyber resilience pay lower premiums.

AI-based threat detection could become a condition for lower premiums, as insurers increasingly see proactive security measures as a way to reduce risks.

| Cyber insurance is not a silver bullet but is increasingly essential for managing the financial impact of cyber risks. |

|---|

| It’s not just about buying a policy—cyber insurance can drive significant changes in how organizations approach cybersecurity. By improving security postures, aligning with compliance standards, and refining incident response, companies are better positioned to prevent incidents and recover from them effectively. |

Would you like:

📊 A slide deck summarizing the impact of cyber insurance on security policies?

🧑💻 A checklist for implementing security improvements based on insurance requirements?

📝 A detailed white paper on the role of cyber insurance in mitigating specific types of cyber risks?

Let me know how you'd like to explore this!

#trending #latest

Explore the Duolingo English Test for Indian Students Abroad... Read More.

Simple Steps to Get Your Canada Student Visa in 2025... Read More.

Fake posts hit Czech PM Fiala's X

Fake posts hit Czech PM Fiala's X

Fake posts disrupt Czech PM Fiala's X account security

Switzerland Tightens Export Rules

Switzerland Tightens Export Rules

Switzerland expands export controls on dual-use goods

Google unveils Ironwood AI chip

Google unveils Ironwood AI chip

Google introduces Ironwood chip to accelerate AI tasks & apps

TSMC Q1 revenue up 42%

TSMC Q1 revenue up 42%

TSMC sees 42% revenue surge in Q1, surpassing forecasts

Google unveils Ironwood AI chip

Google unveils Ironwood AI chip

Google's Ironwood chip boosts AI processing and app speed

Amazon CEO Outlines AI Vision

Amazon CEO Outlines AI Vision

Amazon CEO reveals AI investment plans in new letter

Osaka Hosts World Expo 2025

Osaka Hosts World Expo 2025

Japan blends tech and culture at Osaka Expo 2025 launch

© MyEduGoal. All Rights Reserved. Design by markaziasolutions.com